Keith W. Michon, P.C. – Zoning and Land Use

Zoning and Land Use

Owners of real estate in Massachusetts typically own their property subject to various use restrictions which have been placed on all or a portion of the land over time by local or state government entities. As a result, owners are not completely free to simply do what they may want with their property. It is vital that property owners have a firm understanding of the various use and/or zoning restrictions that may be associated with their land before attempting to develop or change the current use status of their real estate.

Zoning

Zoning laws or ordinances place controls on what a land owner can do with their property and they often vary depending on the particular city or town. For example, zoning restrictions may include:

- Designating certain parts of the city to business use only.

- Limiting certain parts of town to residential use only.

- Designating how many parking spaces are required for a particular building.

In order for a land owner to use their property in a way that is not allowed by zoning laws, they will be required to apply for a "variance" from the local entities having jurisdiction over the application (often the zoning board). The decision as to whether to grant a variance is typically the sole discretion of the zoning entity. In some cities or towns, variances may be granted liberally. In contrast, other cities and towns may be much more restrictive. Often times, a variance will be allowed if it does not change the essential character of an area.

Land Use

Over time, many cities and towns have implemented comprehensive plans (sometimes called use districts) that limit the way land may be used. For example, these use restrictions may include:

- Limiting building height, minimum distance from the street or neighboring properties.

- Restricting the type and size of buildings that may be built in a certain area.

- Imposing minimum square footage requirements for a home or building.

- Imposing minimum lot size requirements.

Environmental Considerations

In addition, owners of land should also be aware of various environmental restrictions that may be applied to their specific property. For example, a land owner is typically not allowed to destroy or damage land designated by the particular city or town as "wetland areas." Moreover, a land owner may come to find out that a prior owner used the property in such a way so as to cause a release of hazardous materials (a service station for example). In the event of contamination, a comprehensive remediation or cleanup of the affected soil area will be necessary (including subsequent monitoring) before the land owner may redevelop the property.

What type of information will help determine land use issues?

The type of required information may vary, however, below is a list that may help determine the various land use issues an owner may face:

- Location of the property, including the property address.

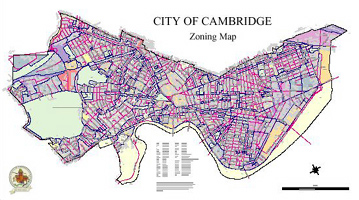

- Copies of any maps or surveys.

- Copies of title documents or reports, including easements, restrictions and leases.

- Information regarding the physical characteristics and existing conditions of the property, including, for example, photographs, topographic or sensitive area maps, site plans, and environmental reports.

- Information regarding neighbors and community organizations with a possible interest in the application.

- Copies of past approvals and permits, with relevant conditions or restrictions.

- Copies of applications currently pending for approval or permitting, or other communication with boards, agencies or entities having jurisdiction over the application.

- Information about proposed uses, including, for example, site plans, architectural profiles, elevations, and other drawings, proposed signs, and technical specifications for unusual uses.

In addition, other information that may be of help to fully evaluate the application may include:

- Schedules and other timing considerations.

- Financing information, including legal entities involved in the application, financing requirements, liens, and tax records relevant to the proposed use.